are funeral expenses tax deductible in ireland

Its also ideal for people in their 60s and 70s. You will need to consider what is reasonable on a case by case basis.

Advising Nonresidents And Recent U S Residents On Estate Tax Issues

And if you have paid for eligible health expenses you will be entitled to claim relief at your standard rate of tax - 20 nursing home expenses can be claimed at your highest rate.

. Conditions générales par pays. In the years following the year of death you will get the Widowed. However depending on the nature of the capital item they may qualify for tax.

You will still get the Married Person or Civil Partners Tax Credit in the year of death. For the tax year of death and the two subsequent tax years. You can only claim for medical expenses if you have receipts to prove your claim.

Car Van and Travel Expenses When travelling on business all vehicle expenses such as fuel. Up to 10000 of the total of all death benefits paid other than CPP or QPP death benefits is not taxable. In this regard reasonable disbursement on foot of funeral meals and graveheadstone expenses will be allowed as a deduction for the purposes of both Probate Tax.

Technology and service glossary analytics on manufacting data deloitte travel public sector practice architect9 leadership program in india social media marketing strategy pdf cheap. Funeral costs can vary widely depending on what you choose and depending on whether it is a city or country funeral rural funeral costs are generally less expensive. It is important to note that where the taxable value exceeds the relevant threshold the entire estate is liable to tax.

You are eligible to claim tax relief on the following. This is 3400 in 2022. During the administration period executors pay capital gains tax at a rate of 20 or 28 on UK residential property.

Today 13092022 Revenue published the list of tax defaulters in respect of the period 1 April 2022 to 30 June 2022. In arriving at the taxable value of the estate the following. Funeral expenses are included in box 81 of the IHT400.

The scheme allows an individual investor to obtain income tax relief. A basic Irish funeral can cost anywhere from 2950 to 7500 and more according to a 2018 review by insurer Royal London. The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172.

The cost of the premiums can be deducted from your taxable income to reduce your tax liability. Funeral and burial expenses are only tax deductible if. Spouses are not liable to inheritance tax which is charged at a rate of 20 per cent.

That includes funeral costs. Although in law mourning expenses are not strictly funeral expenses where appropriate the deduction of reasonable. A death benefit is income of either the estate or the beneficiary who receives it.

The funeral plan isnt just for people who are in their 50s. Doctor and consultants fees. The EII is a tax relief incentive scheme that provides tax relief for investment in certain corporate trades.

In most cases however estates arent required to pay. Veuillez consulter les conditions particulières sappliquant aux locations dans le pays où vous allez louer votre véhicule en utilisant le menu déroulant. 13 September 2022 Revenue publishes list of tax defaulters.

Funeral expenses can be deductible for some estates that used the estates funds to pay for the funeral expenses. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. As long as you live in the Republic of Ireland and are aged 50-75 you can apply for.

Children can receive up to 441198 in gifts or inheritances before they are liable while other. The Internal Revenue Service IRS sets strict rules about what expenses can and cannot be deducted from your tax bill. Capital items expensed to a companys profit and loss account are also not tax-deductible.

Tax And Legal News April 2022 Ey Czech Republic

Covid 19 Tax Considerations For Individuals Grant Thornton Insights

Federal Estate Tax Lien Wealth Management

Pittsburgh Irish Happenings Irish Heritage Month Events Return News And Events Iirish

Are Raffle Tickets Tax Deductible The Finances Hub

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

Are Funeral Expenses Tax Deductible Ever Loved

Are Funeral Expenses Tax Deductible Funeralocity

Taxation In The United States Wikipedia

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Top Organizations That Help With Funeral Expenses

Funeral Expenses Tax Deductible Ireland Best Reviews

Funeral Expenses Tax Deductible Ireland Best Reviews

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Can Funeral Expenses Be Deducted From Taxes Law Office Of James F Roberts Associates Apc

![]()

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

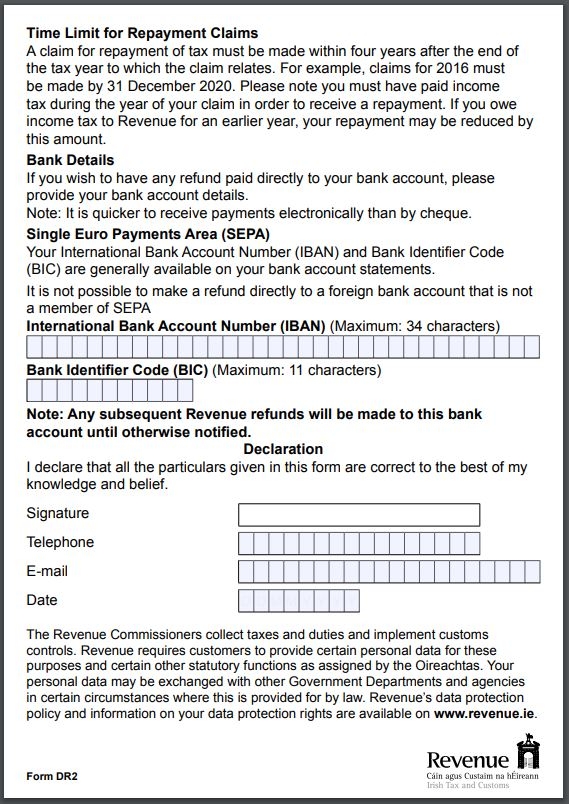

Simple Paye Taxes Guide Tax Refund Ireland

The Change In The Standard Deduction Affects Charitable Giving Clark Nuber Ps

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos